There are over 3.4 million authorized drivers in Louisiana, and Shreveport is the third biggest city in the Bayou State. Drivers in Shreveport pay a normal of $841 for least inclusion and $2,436 every year for full inclusion, as per Bankrate's 2021 investigation of cited yearly expenses.

Bankrate looked into a few carriers and discovered modest rates for Shreveport drivers, yet various carriers offering solid client assistance evaluations, extraordinary monetary strength, numerous inclusion choices, and limits.

Best car insurance organizations in Shreveport

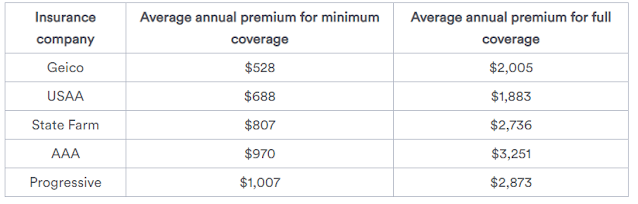

Bankrate's 2021 accident coverage study tracks down a few public carriers offering numerous advantages to clients all through Louisiana, from monetary solidarity to adaptable arrangements. Notwithstanding these extraordinary advantages, Geico, USAA, State Farm, and Progressive offer exceptionally cutthroat and modest car insurance rates in Shreveport.

*USAA isn't qualified for true positioning with J.D. Force because of qualification limitations

State Farm

State Farm is the largest provider of auto insurance in the country, and has a wide range of policy options and discounts available to drivers in Shreveport. Although it is considered the largest, State Farm scores below industry average with an 835 out of 1,000 points with J.D. Power, the lowest among the carriers included. However, the financial strength rating of A++ with AM Best and the competitive premiums may make it a top choice for consideration.

More Review Sate Farm Insurance

Progressive

Progressive is another top provider of insurance in the U.S. and offers some of the least expensive rates in Shreveport. While not as large as State Farm, Progressive does score higher with J.D. Power, earning an 848 out of 1,000 possible points for customer satisfaction. Progressive has numerous discounts available, including the Progressive Snapshot where your safe driving habits are monitored via telematics and you may be eligible for greater savings.

More Review Progresive Insurance

Geico

Geico is the most reasonable choice for drivers in Shreveport, with the most affordable expenses among the carriers on the rundown. In addition to the fact that Geico impresses with the lower charges, however, the higher positioning with J.D. Force addresses the general consumer loyalty. The limits are ample as well, with limits including military, club connection, great understudy, and multi-strategy to give some examples.

More Review Geico Insurance

USAA

USAA has probably the most minimal rates for charges among the carriers in Shreveport. On the off chance that you meet the qualification models as an individual from the military, veteran, or close relative of a service member, you will discover USAA offers both essential and modified collision protection approaches, and a wide number of limits as well.

More Review USAA Insurance

Inexpensive car insurance in Shreveport

Louisiana has the most elevated accident protection rates in the nation, as indicated by the Insurance Information Institute. Bankrate discovered something very similar to be the case when rates were inspected across the states and discovered Louisiana drivers pay a normal of $2,724 every year for full inclusion. Rates in Shreveport are similarly high, with drivers paying a normal of $2,436 for full inclusion.

The uplifting news is various public carriers are offering cutthroat rates for drivers in Shreveport. For example, not exclusively do Geico, USAA, State Farm, AAA, and Progressive all offer less expensive charges, every one of these carriers gets, at any rate, A rating from AM Best for monetary strength. Every one of these carriers likewise offers various limits to help further diminish the expense.

Shreveport insurance necessities

Louisiana expects drivers to carry a base measure of obligation insurance, which should incorporate 15/30/25 in responsibility limits.

- $15,000 real injury risk per individual

- $30,000 substantial injury risk per mishap

- $25,000 property harm risk per mishap

Be that as it may, buying just the base inclusion in Louisiana isn't suggested by insurance specialists, since you would pay higher cash-based costs when you have restricted inclusion. Another highlight remember is if you rent or money a vehicle, the loan specialist will probably expect you to add thorough and crash inclusion to your approach. Hole insurance is once in a while needed by moneylenders as well, which pays the distinction between the devalued worth of a vehicle and what you owe on a credit, should your car be added up to form a to blame mishap.

Car insurance reduced fare in Shreveport

Since Louisiana inhabitants pay probably the most elevated car insurance rates in the nation, discovering limits is particularly basic to help balance a portion of the expense to drive legitimately. Luckily, there are various limits accessible, including:

- Multi-strategy: If you buy accident coverage from a similar carrier as your property holders or leaseholders insurance carrier, then, at that point you might have the option to get a packaging rebate.

- Cautious driver: If you consent to take a Defensive Driving Course, and one supported by the carrier, then, at that point you may acquire a markdown on expenses, as well as learning significant street security tips.

- Fork over the required funds: If you consent to pay your whole expenses front and center, rather than separated into a month to month or quarterly portions, then, at that point you may get a markdown for forking over the required funds.

- Great understudy: If you endeavor to keep your grades up, you may get additional awards as limits on expenses.

These are just a small bunch of limits accessible. If you are an individual from the military or veteran, on the off chance that you are viewed as a Senior Driver or quite a few other unique conditions, then, at that point, you may discover extra limits accessible. The remaining ticket and mishap-free are perhaps the most ideal approaches to pay the least sum, however, limits are profoundly valuable.

As often as possible posed inquiries

What is the best car insurance organization?

The best car insurance organization is the one that meets your definite necessities while permitting you to in any case remain inside the financial plan. Think about numerous components, for example, client care appraisals, monetary strength, and inclusion choices while deciding the best for you. Bankrate has looked into a few and discovered USAA, Amica, and Geico are large forces to be reckoned with dependent on this equivalent data.

What amount does car insurance in Shreveport cost?

The normal rate for car insurance in Shreveport is $841 for least inclusion and $2,436 yearly for full inclusion. In any case, your definite car insurance rates are dictated by factors explicit to you, like your age, vehicle, traveling history, the number of miles driven, and FICO assessment. Your rate might be higher or lower contingent upon these variables.

Philosophy

Bankrate uses Quadrant Information Services to investigate 2021 rates for all ZIP codes and carriers in each of the 50 states and Washington, D.C. Cited rates depend on a 40-year-old male and female driver with a spotless driving record, great credit, and the accompanying full inclusion limits:

- $100,000 substantial injury responsibility per individual

- $300,000 substantial injury responsibility per mishap

- $50,000 property harm responsibility per mishap

- $100,000 uninsured driver real injury per individual

- $300,000 uninsured driver substantial injury per mishap

- $500 impact deductible

- $500 extensive deductible

To decide the least inclusion limits, Bankrate utilized the least inclusions that meet each state's prerequisites. Our base profile drivers own a 2019 Toyota Camry, drive five days per week, and travel 12,000 miles yearly.

These are test rates and ought to just be utilized for similar purposes.